Navigating Tax and Taxation for Artists and Creative Professionals in India (Updated for 2025)

From income tax considerations to navigating the complexities of Goods and Services Tax (GST), understanding the taxation landscape is crucial for maintaining compliance and optimizing financial management. In this comprehensive guide, we dive into the intricacies of taxation for artists and creative professionals, exploring both direct and indirect tax structures and providing insights to help navigate this complex terrain.

Before we start, I need to be clear – the information I provide is through my own experience in the industry and research that I have done myself, you should do your own as well and therefore I am obligated to put out this Disclaimer before you read any further.

Disclaimer

This article is intended for educational and informational purposes only. I am not a Chartered Accountant (CA), lawyer, or certified tax professional. The content herein should not be construed as legal, or tax advice.

Tax laws are subject to change, and individual circumstances vary greatly. Readers are strongly advised to consult with a qualified Chartered Accountant or tax professional before making any financial or compliance decisions. All information provided should be reverified for accuracy and relevance to your specific situation.

So now that we have that out of the way, lets lay some ground work…

Why are Artists Taxed Differently?

We always knew we were different, didn’t we? Jokes aside, Artist don’t fall under the usual tax structures; income amounts fluctuate and with multiple sources of income like gigs, royalties, licensing deals, merch sales and streaming, we can conclude that most likely you are not salaried; or if you are, that’s not your only source of income.

You are a freelancer and that comes with a unique tax setup. Salaried employee have their taxes deducted by their employer, but you as a freelance are responsible for declaring and paying your own. You need to understand how each income source is taxed and you need to record information meticulously to get it right.

You’ll typically fall into one of these categories:

- Freelancer under ITR-3 or ITR-4 (depending on whether you opt for presumptive tax)

- Business owner if you’re registered as a company or LLP

- Salaried professional (less common for full-time artists)

Most artists will need to file ITR-3 or ITR-4.

An Introduction

Let’s face it, Taxation can be complicated for just about anyone, schools never really taught us about money nor how to deal with taxes once we start earning it. For Artists and creative professional – as a DJ, producer, visual artist, freelancer, music teacher, or session musician, be it in India or anywhere – with inconsistent income, multiple revenue sources and confusing Government portals with deadlines that sneak up fast, its no wonder that artist either leave it to the last minute or get it wrong.

We created a guide to help you avoid trouble, protect your income, navigate tax’s, plan ahead and start thinking like a financially aware creator.

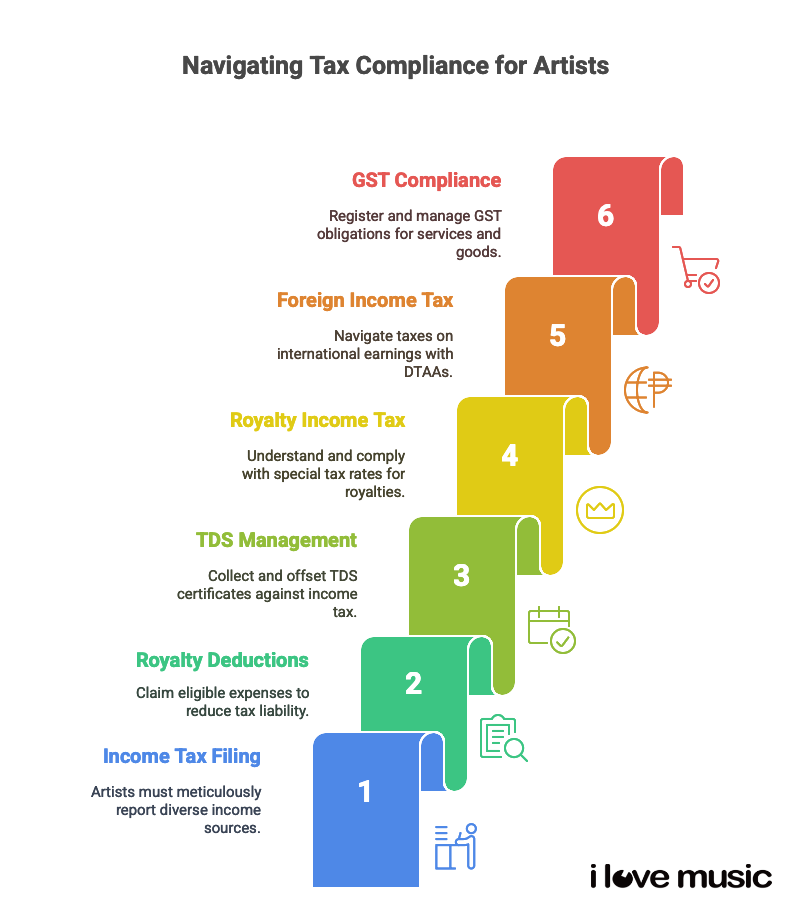

What will we cover:

- Income tax

- Deductions

- TDS Management

- Royalty Income

- Foreign Income

- GST Compliance

So let’s dive right in!

Income Tax:

Income tax is a direct tax charged by the Government every year. A portion of your earning as an individual or business for the year is paid to the Government. In India Income tax is governed by the Income Tax Act, 1961, which lays out the rules and regulations for income tax calculation, assessment, and collection.

Understanding Your Income: What’s Taxable and What’s Not

Taxable Income:

- Gigs or performance fees

- Teaching income (private or contracted through institutions)

- Royalties (streaming, licensing, sync, publishing)

- Brand deals, sponsorships, influencer partnerships

- Social media revenue (YouTube, Instagram)

Potentially Exempt (but must be reported):

- Artist grants or fellowships (depends on source)

- Awards or prize money

- Certain foreign remittances

Each of these is taxed differently

Pro Tip: Always declare your income. A Financial Advisor or Chartered Accountant (CA) can help determine what’s taxable.

Income Tax slabs and the Tax Regime

Tax slabs can also be a cause of confusion. Should one follow the old tax regime or stick to the default new one?

The old tax regime allows you to claim certain benefits and deductions; however, the tax brackets have not been updated for a while.

Stuff like paying Insurance – Life and Medical, Housing allowance, EMI on Home purchase, etc., came with some deductions and benefits which helped in lowering taxes and substancial savings.

| OLD Income Tax Slabs | Income Tax Rates |

| Up to Rs. 2.5 lakh | NIL |

| Rs. 2.5 lakh – Rs. 5 lakh | 5% |

| Rs. 5 lakh – Rs. 10 lakh | 20% |

| Above Rs. 10 lakh | 30% |

The new tax regime, updated in the Union Budget 2025, applicable from 1st April for the financial year 25-26, does not offer the old exemptions. However, it does offer enhanced and attractive tax brackets.

| NEW 2025 Income Tax Slabs | Income Tax Rates |

| Up to Rs. 4 lakh | NIL |

| Rs. 4 lakh – Rs.8 lakh | 5% |

| Rs. 8 lakh – Rs.12 lakh | 10% |

| Rs.12 lakh – Rs.16 lakh | 15% |

| Rs.16 lakh – Rs. 20 lakh | 20% |

| Rs. 20 lakh – Rs. 24 lakh | 25% |

| Above Rs. 24 lakh | 30% |

In addition, there is also a special exemption on income tax payable if you earn up to 12 lakhs a year - yup, if you earn up to 12 lakhs in total - NO TAX to be paid. But remember, no exemptions are applicable, and once you cross 12 lakhs in earnings, you are taxed on the full amount.

Both old vs new tax regimes have benefits as well as drawbacks. Before deciding, understand the differences between the old and new tax regimes in detail. The previous tax structure instills in a taxpayer the habit of saving. The new tax structure benefits those who earn less and invest less, resulting in fewer deductions and exemptions.

I know this can get a bit overwhelming, but don’t decide by just reading this article; speak with a tax professional and understand everything in detail before moving forward on this one.

Choosing the Right ITR Form

- ITR-4: Freelancers under presumptive tax (Section 44ADA) earning under ₹50 lakh

- ITR-3: If you earn from multiple sources or don’t opt for presumptive tax

- ITR-1/2: Mostly for salaried individuals (not applicable to most artists)

Consult a CA who understands the creative sector to select the right one.

What is Presumptive Tax:

A lot of Tax accountants and CA’s have involventary opted this for their Freelance and creative Clients by default and yours may have done so as well, which may not be beneficial for you. This should be your decision and being informed will help you make the choice rather than letting someone else choose for you.

To put it plainly, you can simplify your accounting by calculating your profits as a Percentage of your Turnover (Total Earnings) in a year. It’s a quick and easy way to simply accept 50% of your earnings as profit and pay tax on that amount and avoid detailed cumbersome accounting of expenses and bills – this saves a lot of time for your accountant and CA.

But, if you are following this guide I would recommend not to jump in so quick. You can spend a little time and practice SMART accounting practices by considering every business expense and pay tax only on your actual profit, you may be surprised to see that you save more tax with that extra effort you put in.

Direct Tax Considerations

- Track Freelance & Royalty Income

- Track income from all gigs, music sales, and teaching assignments.

- Maintain proper documentation—contracts, bank statements, invoices.

DEDUCTIONS:

Income – Expense = Profit

Pro Tip: You are taxed only on your profit.

Tax deductions or deductibles play a vital role in lowering taxation liability for artists and creative professionals. Please note this is separate term from TDS. But not all expenses can be treated as deductions. Therefore reasonable, legitimate, justified business expenses can be offset if you know what they are and how to present them correctly.

Claim legitimate expenses like:

- Studio rent

- Equipment/software

- Training courses

- Travel for shows

Maintain receipts and categorize them properly.

Also consider Royalty Deductions: Under Section 80QQB of the IT Act further enhance tax benefits for recipients of royalty income. Accurate reporting and compliance with tax laws are essential for individuals or entities receiving royalty income to avoid penalties and ensure transparency in taxation. We talk more about this in section covering Royalty management below.

TDS (Tax Deducted at Source)

Clients may deduct TDS before paying you. Collect Form 16A from them and share with your CA—it helps lower your final tax liability.

2025 Update: Platforms like YouTube, Spotify, and influencer agencies may deduct TDS even below ₹30,000 if they act on behalf of registered companies.

So what is TDS?

When you earn money by providing a service as a Freelancer; Your client deducts a portion of your payment (normally 10%) and this amount is paid to the government on your behalf as part of your income tax. It is a legal requirement for all Organisations / Companies / Institutions to do so (as a compliance). Individuals normally do not deduct TDS before paying you, except for in certain cases such as RENT paid over 50,000/- but that does not concern your artist income.

Simply put, it’s just a way for the government to track your income and ensure they receive their share of your taxable income. Your Chartered Accountant (CA) will tally all the TDS withheld against your income and offset it against your Final income tax payable. This will reduce your taxable income at year end so remember to collect those TDS certificates (Form16A) on time and ensure you get the benefit of all the TDS deducted. The TDS paid to the government on your behalf is off set against your calculated income tax and you either pay the difference or get a refund from the government. You can understand this as tax paid in advance on your behalf.

Advance Tax

If your estimated annual tax due exceeds ₹10,000, you must pay advance tax in four instalments (June, Sept, Dec, March). Missing this leads to interest penalties. So tax estimations need to be assessed and addressed (Quarterly) 4 times a year, not just at year end. However if you are confident that your TDS will take care of this, you can rest easy. Ask your Tax consultant, Financial advisor or CA to help you with this.

Royalties & Section 80QQB

Royalty income, a significant revenue stream for artists and creative professionals, is subject to special tax rates. The latest amendment to the Finance Bill, 2023, introduced a reduced taxation rate of 20% on royalty income, recognising its unique nature and contribution to the creative industry.

Under the revised structure, royalty income from various sources, including music, literary works, patents, trademarks, and franchises, is taxed at the preferential rate of 20%.

In 2025 Royalty income continues to be taxed at a preferential rate of 20%, under Section 115A for non-resident artists and applicable provisions for residents.

Royalty Deductions:

Under Section 80QQB of the IT Act , literary and musical artists can claim up to ₹5 lakh/year in deductions (increased from ₹3 lakh in 2025), if they’re resident individuals. Applicable only if the work is original and not educational textbooks.

Income from Foreign Sources

If you’re earning from abroad, i.e Foreign income, such as royalties from international releases or digital content monetised abroad, may be taxable in India based on your residency status.

Use India’s Double Taxation Avoidance Agreements (DTAAs) to avoid paying tax twice. If foreign tax has been deducted, you may claim Foreign Tax Credit (FTC) in India.

2025 Update: To claim Foreign Tax Credit (FTC), file Form 67 before 30th November of the assessment year.

Indirect Taxes: GST and You

The introduction of GST in 2017 brought significant changes to the indirect tax landscape, impacting various sectors, including the music industry. GST is levied at different rates on goods and services, with specific implications for artists and creative professionals.

GST Registration

Register if your revenue exceeds:

- ₹20 lakh (normal states)

- ₹10 lakh (special states – Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, and Sikkim only)

You MUST register if:

- You work across states (interstate supply)

- Use online platforms to provide services

- Export digital services (However LUT – letter of undertaking can allow 0% GST)

GST Rates & Categories snapshot:

- Indian handcrafted instruments: 12%

- Western/electronic instruments: 18%

- USBs, Tapes ,CDs: 12–18%

- Live shows:

- < ₹250: Exempt

- ₹251–₹999: 12%

- ₹1,000+: 18%

Always Include SAC (Services Accounting Code) or HSN codes in your GST invoices depending on the nature of the product or service.

Folk/Classical Art Exemption

As per Notification No. 12/2017, performers of folk or classical art forms (music, dance, theatre) are GST- exempt up to ₹1.5 lakh/ performance.

Does NOT apply to:

- Modern or Western genres (EDM, pop, Hip-hop, etc.)

- Brand endorsements or commercial appearances

Most contemporary performers will charge 18% GST once registered.

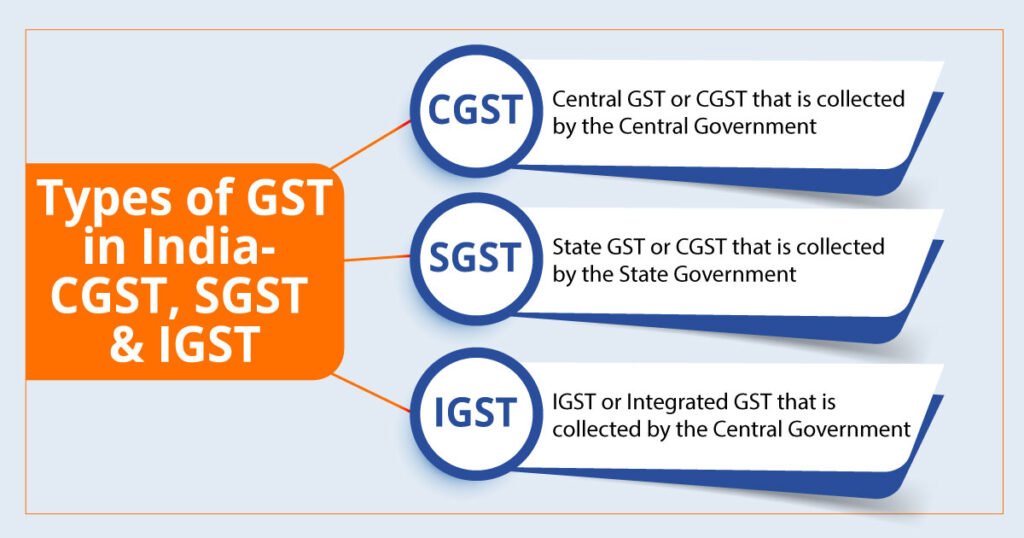

When supplying service or selling product within the state – CGST & SGST is applicable while IGST is applicable for Interstate supply or goods and services

Common Mistakes Artists Make

- Mixing personal & professional expenses

- Ignoring advance tax deadlines

- Not collecting Form 16A (TDS)

- Filing the wrong ITR form

- Missing GST registration when required

Your Artist Tax Toolkit for 2025

Documents to Prepare:

- PAN, Aadhaar

- Gig invoices

- TDS certificates (Form 16A)

- Royalty contracts

- Bank statements

- Previous ITRs

Optional Tools:

- Google Sheets/Excel trackers

- Expense recording apps

- A CA with experience in music/creative fields

In Conclusion

Tax literacy is essential for any artist who wants to build a sustainable career. Know what you earn. Track your expenses. File on time. Seek help when needed.

Consulting with experienced professionals or chartered accountants specialising in financial management for creative fields can provide invaluable guidance and support in navigating the intricacies of taxation, allowing artists to focus on their creative endeavours while managing their tax obligations effectively.

Key Takeaways:

- • Maintain records of all income and deductible expenses.

- • Regularly collect and reconcile TDS certificates.

- • Register for GST if you provide interstate or digital services.

- • Use proper SAC/HSN codes in invoices.

- • Claim applicable deductions under Section 80QQB and FTC for foreign income.

With proper planning, artists can stay compliant while focusing on their craft.

2025 Key Updates Recap

| Topic | 2025 Change |

| Royalty Deductions (80QQB) | Increased to ₹5 lakh/year |

| TDS by Aggregators | Now applies even under ₹30k in some cases |

| Foreign Tax Credit | Form 67 deadline: 30th November |

| GST Threshold | No change – ₹20 lakh/₹10 lakh remains |

| Folk/Classical GST Rule | Reconfirmed – does not apply to modern forms |