Make the science of Managing your Music Income and Expenses part of your Art.

Managing money is a vital skill required for any business, and it’s no different in the business of music. If you’re an electronic music artist- a bedroom producer starting out, getting into the gigging circuit, spinning tracks across festivals or a well established touring DJ with multiple revenue streams, managing your money is one of the most important skills to a sustainable music career. Money might not be the muse behind your art, but tracking it wisely can help you level up financially and creatively.

The thought of taking your income and expenses may seem like the most tedious task, but its one of the smartest moves you can make as an artist, and the earlier you start doing it – the better.

In this guide, you’ll learn why tracking finances matters, what tools to use, and how to do it like a pro—without needing an accounting degree.

Why does Tracking Your Music Money Matter?

When you understand your music money deeply, you can align your creative choices with financial sustainability. Being a musician or performing artist today is more than just a creative endeavor. Use all the fancy terms you want – creative entrepreneur, artist-preneur, etc; but at the end of the day you are in a Business – “the business of music” and here’s what you gain by tracking your Music Money:

- Cash flow: Know how your money moves, where it comes from and where its going. If music is a Business, and yes it is exactly that, note that almost 80% of small businesses fail because of improper management of cash flow. It’s the movement of money into and out of your pocket during a specific period. Simply put, tracking all the financial transactions in your Music business.

A Positive cash flow means that cash inflows exceed the outflows, allowing you to meet your costs, reinvest in growth, or save for future needs. On the other hand, negative cash flow happens when more money is going out than coming in, which leads to financial strain and liquidity issues.

- Tax Readiness: If you know what money the government has already collected during the year (via TDS) and have set aside how much more you will owe in Income tax by year end, you are already ahead of the curve. Be ready from the get go- on whats owed and staying organized with your documents during tax season. Do some homework, speak to some professionals to get an understanding of income tax and GST compliance. This will help you to stay on top of things.

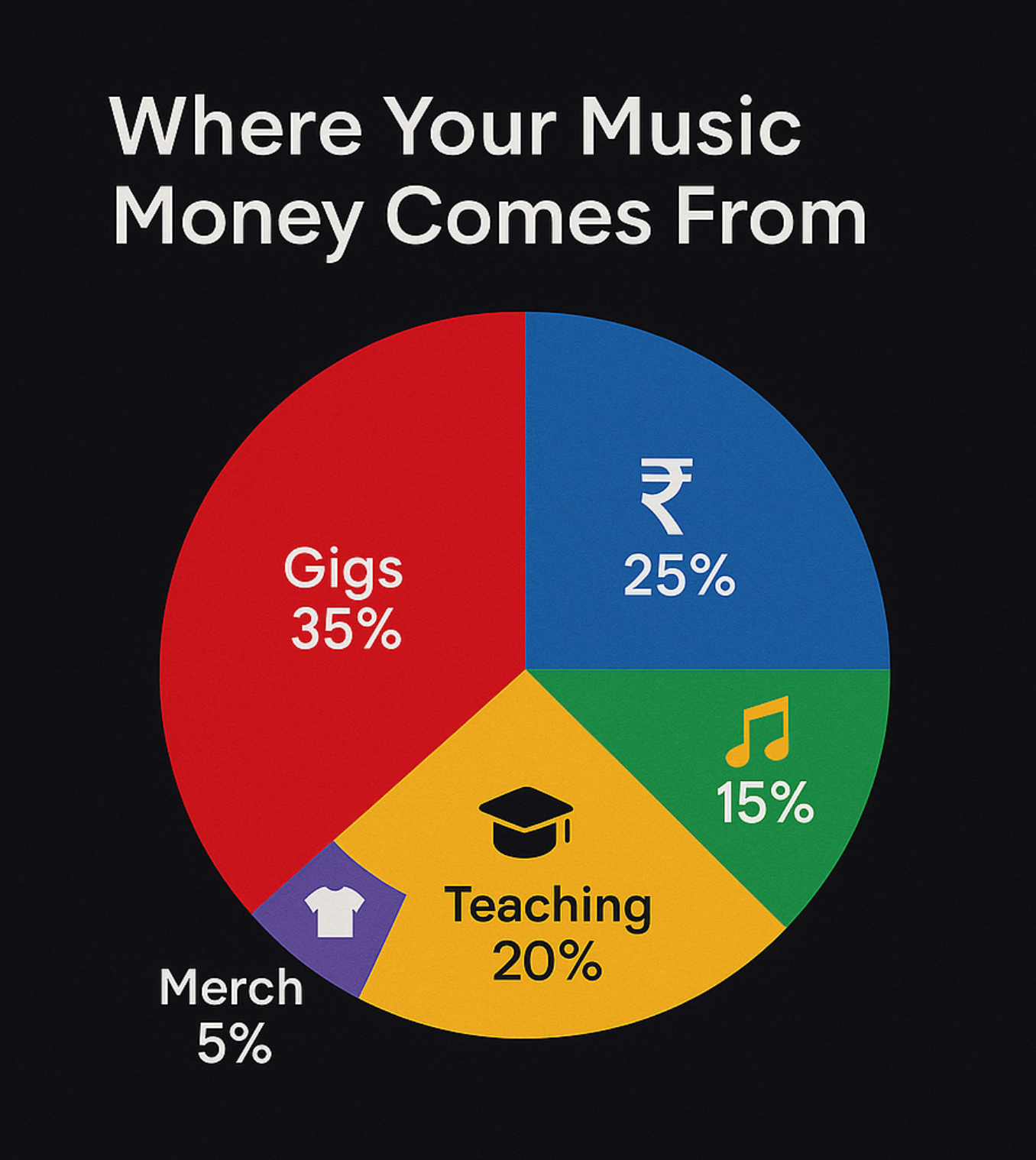

- Better Business Decisions: Put your efforts in the right place. See which gigs, platforms, or services generate the most return. You can then make decisions based on past history and plan your future bookings to ensure you maximize your efforts.

- Funding Opportunities: How to get the money you need for that next project – an album / a studio / a music video – Many grant applications & loans require basic financial reporting. A clear understanding of how efficient you are in using your resources will give more confidence to the issuers when you apply – be it an investor, loan or grant.

- Long-Term Growth: Helps you plan for gear upgrades, tours, and investments. You can plan to upgrade your gear or even take advantage of flash sales/ discounts/ rare finds and at times other musicians selling off a prized possession that you have always had your eye on. Touring is expensive and being financially prepared helps with any last minute expenses or road blocks to make it happen. Investing for the future is something we rarely think of when living in the present, but its as important and achievable with a little planning and a little help.

- Financial Clarity: It isn’t just about the numbers; it’s about perspective – the ability to see, understand and strategize what you are working so hard for.

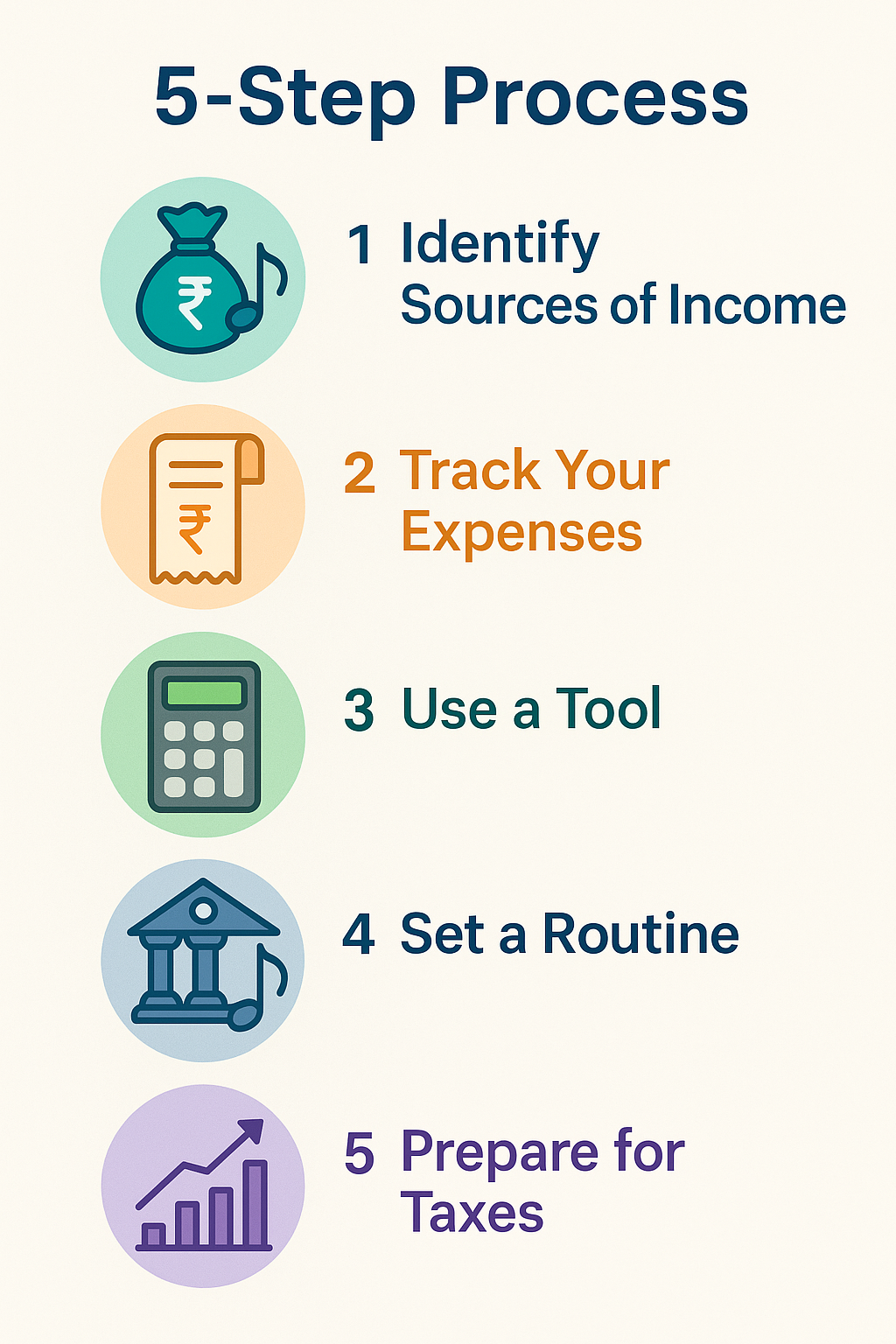

How, The 5 steps to managing your Music Money!

Here’s your roadmap to managing every rupee that enters or leaves your pocket—with confidence and simplicity.

Step 1: Identify the sources of Income in Music

Start by listing all the ways you earn music money. Common income streams for electronic musicians can include:

- Live gigs & DJ sets

- Streaming royalties (Spotify, Apple Music, etc.)

- Sales from your Music Downloads (Bandcamp, Beatport)

- Merchandise sales

- Sample pack sales

- Sync licensing (TV, ads, games)

- Residencies & Contracted work

- Sponsorships or brand deals

If I have missed any out, please do ping me and I will update the same here.

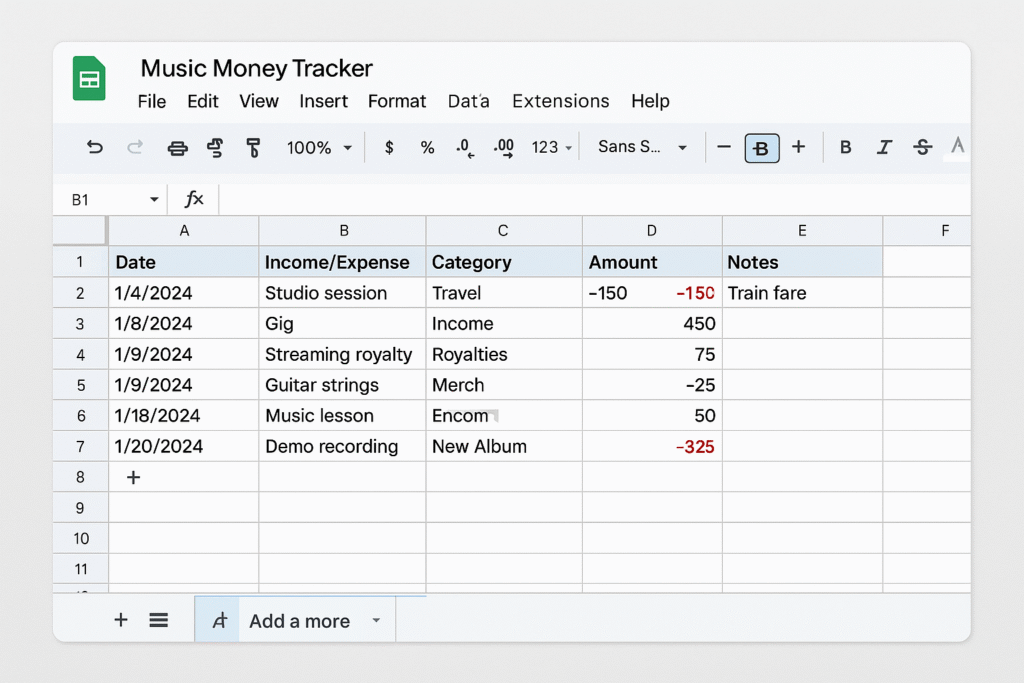

Create a spreadsheet to track your monthly music money inflows.

Step 2: Track Your Music Money Expenses

The Business of Music will have income and expenses, therefore you’ll have costs to track. Every rupee you spend on your art counts as music money outflow. By organizing your music money costs by type, you gain valuable insight into your business. These might include:

- Asset purchases like – Equipment (controllers, headphones, mixers)

- DAWs & plugins (Ableton, Serum, etc.) – Intangible assets that you will use till the next update

- Studio rent which is recurring or a room treatment and setup costs that may be one time.

- Advertising, Marketing and social media ads for promotion of your music or gigs to gain publicity, sell tickets or add followers/fans.

- Travel, Boarding and lodging (TBL) & Food & Beverage (F&B) consumption for gigs

- Team payments (managers, graphic designers, engineers, etc): Why do it alone when we work better as a team. The backend and support staff that keeps you functional needs to be paid on time to keep the wheels of your business turning without issue.

- Other Artists – Jr Artist or Opening Acts, accompanying-performers, dancer, Hype artists, MC’s etc . Often Artists take on hiring other artists and performers to strengthen their onstage presence or as opening act. If you are responsible for paying them then you need to tack the expense.

- Mixing and Mastering services for music release + Distribution fees (DistroKid, Ditto, etc.) The final touches to your masterpiece can make all the difference to an Audio Symphony or just a hot-mess. Give Money and Credit where it’s due and record the expense to building your future assets.

There may be more expenses that don’t fall under the categories above that I have missed, do connect to help me plug those gaps.

Pro Tip: Categorize your expenses by type - “Gear,” “Marketing,” “Travel”. It helps during tax time and gives insight into your biggest cost areas.

Step 3: Use a System / Use a Tool

For those who prefer a low-tech approach, simply using a notebook to record income and expenses can be effective. Manual tracking is fine, but the right tools save time. WHAT TOOLS?

Tracking your music money manually can get messy and leaves room for errors. Your system should simplify how your music money is recorded and reviewed. Consistency can be an issue without an effective system in place and lets face it we are in the 21st Century, we have a powerful computer in our pocket, lets use it. “Systems work where people fail”. Keep it simple and invest into a system using the right tools to make it happen.

I start with my notes app on my phone to note expenses as they happen so I don’t forget (and use the camera when needed to snap up bills and link them to the note). When I get time I get on the laptop and log in the expense into the Software.

I use Google Sheets / Excel – Free and customizable & frankly the best way to start.

Advanced Financial Tools:

- Wave Accounting – Free accounting software for small businesses

- Zoho Books Self-Employed – Great for freelancers and tax tracking

- Tally – Great for Accountants, and a go-to for CA’s

Music-Specific Tools:

I have heard these tools could make it easier, but I have not used them personally so you would require a deep dive to understand if you can use them:

- Label Engine: For royalty accounting if you run a label.

- BeatStars Accounting: Useful for beat/sound kit producers.

Personally I avoid the complicated softwares and just send my accountant my excel sheets which themselves can be detailed and at times complicated as I track everything. I let the accountant deal with the Accounting softwares and only review the final Financial statements before filing for Taxes or Government compliance.

Like I said keep it SIMPLE, but make sure the system and tools that you employ are manageable by you without an overly complex learning curb.

Pro Tip: You can use automation apps like Zapier to connect Bandcamp/PayPal to your spreadsheet if you use their services.

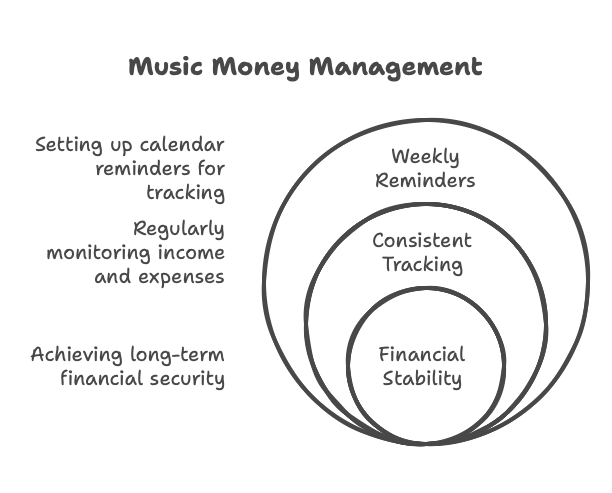

Step 4: Set a Monthly Music Money Routine

Ever heard the saying that “The wealth is in the boring”? Well a Routines Just 30 minutes a month can save you hours (and rupees) later. Here’s a simple monthly workflow:

- Download your Bank statements

- Log all Music Money transactions. A regular habit helps you take full ownership of your music money decisions.

- Categorize and summarize your income & expenses

- Review what’s growing and what’s draining

This habit can help you spot trends—like a growing revenue stream or a bloated subscription you can cancel.

The Wealth Is In The Boring:

In contrast to shortcuts and quick rich schemes or cutting corners for fast cash, the expression “wealth is in the boring” implies that actual and sustainable riches can be achieved through constant, disciplined activity. In contrast to following fads or taking part in highly-volatile activities, the value of consistent, predictable efforts over time, such as saving, making prudent investments, and learning a skill will be more fruitful. You can use this for your Music Skills too, not just managing your music money.

The longer you train/ practice and do something consistently, the better you get at it. Dive deep instead of only skimming the surface. Get your hands greasy and understand how thing work – be it an instrument, that DAW you use or your financials records.

Step 5: Prepare for Taxes Like a Pro

Clean records of your music money help during tax filing and professional reporting. In India and many other countries, independent artists must report income—even if untaxed at source.

Tips:

- Save every invoice and receipt

- Maintain digital and physical copies (read “Saving Bills like a Pro” below)

- Work with a CA (chartered accountant) familiar with Artists and Freelancers

- Know the basics of GST, TDS, and advance tax (if applicable)

If you plan to apply for grants, visas, or loans, clean financial records can be a major advantage.

Pro Tip: Separate Personal & Business Finances. Use a separate bank account or credit card for your music activities. It simplifies tracking and gives your music business a more professional edge.

Saving Bills Like A Pro

Every time you spend your music money and receive an invoice/ bill you can save it easily with a little pre-prep.

If you already use Dropbox or Google Drive, this is going to be easy.

- Create a folder specific for expense bills. And then subfolders for each month of the year. (Tip: the financial year is April to March in India.)

- Now every time you make a payment, scan or take a pic of the invoice immediately from your phone and drop it in the current months expense folder.

- Name the file (scan or pic) with the date and some indication of what it is. Eg. 9th Feb – Nakul’s birthday cake or 2nd April -Taxi to Airport

- Optional – Make a note of the expense (be as detailed as possible) on your notes app and link the pic to the entry if you phone gives you that feature.

- Share access of the folder with your accountant – so he/she can refer to it at month end or when needed.

- The hard copy bill can be dropped into an old shoe box and handed over to your account at year end or as and when he asks for it.

- Your all set, now you can correlate your expenses from your bank statement or credit card bill with the invoice copy if needed.

…As easy as counting your beats 1-2-3-4 🙂

Final Thoughts – Grow with your Money

Tracking your Music Money – income and expenses isn’t just about saving money—it’s about taking control of your music career. Start owning your music money decisions and build a stronger foundation for your future. In an industry driven by passion — clarity around your finances helps you make smarter, faster, and more creative decisions.

Pro Tip: Start treating your music money like a business. Whether you're a hobbyist or a touring artist, managing your music money builds real creative freedom.

Remember:

- You don’t need to be an accountant to take control of your money – Act like a pro.

- Start small, stay consistent, and grow your financial muscle alongside your musical one.

- Even if you do hire a Financial Consultant / Business Manager to manage your money, you will still need to do this.

- The practice of recordings everything will enable you to take informed decisions and better manage your money in the long run.

What To Do Next

- Grab your free Music Money Income & Expense Tracker (Google Sheet) .

- Schedule it: 30 minutes once a month.

- Seek professional help if you are ready to take control of your music finances – Schedule a call to get professional help with a Music Business/Financial Consultant here? – That’s Me 🙂